Reader Question: Monty, we want to make an offer on a house. Our agent wrote up a contract with a financing contingency that says “subject to buyer obtaining financing.” We are wondering if that wording is enough. We asked, and the answer was “you either get a loan or you don’t.” Is our agent right? Michael and Sarah P.

Reader Question: Monty, we want to make an offer on a house. Our agent wrote up a contract with a financing contingency that says “subject to buyer obtaining financing.” We are wondering if that wording is enough. We asked, and the answer was “you either get a loan or you don’t.” Is our agent right? Michael and Sarah P.

Monty’s Answer: Contingencies in purchase agreements are often the source misunderstandings. At a minimum, consider a contingency more along these lines to avoid misunderstanding.

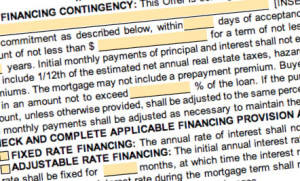

“This Offer is contingent upon Buyer being able to obtain a written [INSERT LOAN PROGRAM OR SOURCE] first-mortgage loan commitment as described below, within ___ days of acceptance of this Offer. The financing selected shall be in an amount of not less than $___ for a term of not less than years, amortized over not less than ___ years. The initial annual interest rate shall not exceed ___%. Initial monthly payments of interest and principal shall not exceed $___. Monthly payments may also include 1/12th of the estimated net annual real estate taxes, hazard insurance premiums, and private mortgage insurance premiums. The mortgage may not include a prepayment premium. Buyer agrees to pay discount points and/or loan origination fee in an amount not to exceed ___% of the loan. If the purchase price under this Offer is modified, the financed amount, unless otherwise provided, shall be adjusted to the same percentage of the purchase price as in this contingency, and the monthly payments shall be adjusted as necessary to maintain the term and amortization stated above.”

Each state has their own philosophies and rules regarding the drafting of contingencies in real estate contracts. The language above is from a state that requires real estate agents to utilized pre-approved state forms.

I am hopeful the agent you quoted in your question is in the vast minority of real estate agents with the flippant response provided to you. You would be doing them a big favor if you were to bring them up to speed by insisting on a specifically worded contingency that greatly reduces the odds of future debate over the contingency being satisfied, or not. It is good for you, but unfortunate here you have a better grasp than your agent.

Getting Drafted

It is the task of your real estate agent to draft concise contingent statements for each particular transaction. It is my belief you must carefully read each statement to make sure it correctly conveys your thoughts and wishes. Here are some basic guidelines to follow when evaluating a real estate contingency:

- It should be specific to avoid misinterpretation. It is not a negotiating tool.

- It should be as reasonable as possible so as not to put either party in a situation that has no hope of being resolved.

- It should include time limits so as not to be interpreted as open-ended.

- It should include definitions whenever applicable and always utilize clear language.

- It should include the “five W’s”; who, what, why, when and where and if there is a cost who pays for it.

Many misunderstandings can be prevented if the contingency is properly drafted. Contingent statements are an excellent way to communicate concerns and are submitted in good faith to facilitate your housing goals.

Become Familiar

Here is a list below of some common contingencies and is only a partial listing. Their use in completing your transaction may or may not be applicable. These are issues addressed by contingencies; they are not the actual wording of the contingent statement. You should become familiar with these and any other considerations unique to your particular situation.

Common Contingencies

“This agreement is subject to…

- Obtaining financing

- Well and septic inspection

- Home inspection

- The sale of buyer’s home

- Survey of the property boundaries

- Repairs to be made by the seller

- This offer becoming the primary offer

- Energy inspection or improvements

- Code compliance

- Inspection

- Joint driveway or well agreement

- Buyer pre-closing walk-thru inspection

- Urea formaldehyde foam disclosure

- Perk test

- Repairs or improvements by buyer before closing

- Safe water test

- Successful closing of another real estate transaction

- Zoning changes

We recommend that you learn which contingencies may apply to your specific transaction. It will be helpful to familiarize yourself with what a contingency is, its purpose and how to draft an effective statement. You will find that contingencies will be a valuable tool during your purchase or sale. Do not wait until you are in the heat of a negotiation to contemplate what obstacles may come your way.