Reader Question: They paid $20K more for the property than it was worth. My daughter and her husband purchased a home for $145,000 and found out a few weeks later, the appraisal was only $125,000. Neither their agent nor the lender advised them of it. Who should have?

Monty’s Answer: There are several considerations here regarding who should have disclosed this information, or if there was a disclosure obligation.

State law determines any legal obligation. The conversations between the kids and both the real estate agent and the mortgage loan originator may create a moral obligation. There can be a fine line between legal and ethical issues because, in certain circumstances and individual states, conversations can create legal agency relationships.

Important points to consider

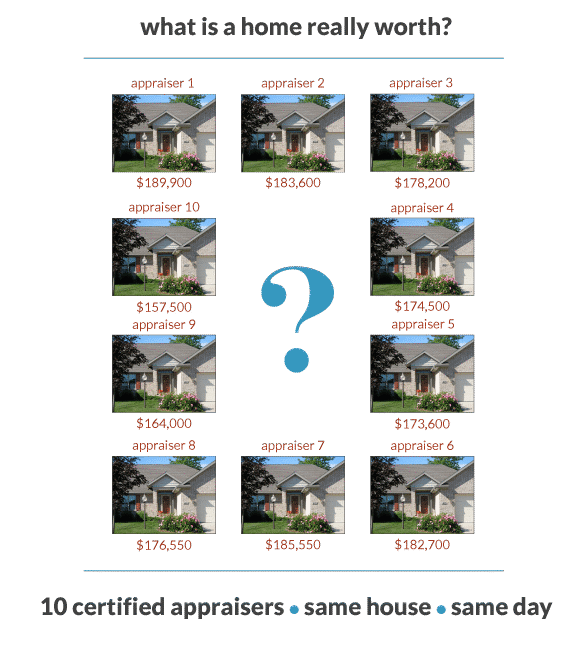

- The value of every home is a moving target. Homes have a range of value, not a number. If they had engaged five appraisers and paid them each three hundred dollars, they would have received five different opinions. Those opinions could vary between five and twenty-five percent. Here is a link to an article about home valuations that provides more information. It would be no surprise if a different appraiser provided a higher estimate for the property.

- The kids paid for the appraisal, but the lender required it as part of the loan application for assessing the risk of lending to them. The appraiser was working for the lender – not the kids. If the lender was satisfied with the appraiser’s opinion and saw little risk, they may approve the loan. It is likely your daughter, and her husband qualified to repay the loan based on their income or the amount of the downpayment they invested toward the purchase price.

- At any time during the home buying process were either the real estate agent or the lender made aware your daughter and her husband wanted the appraisal to be equal to, or higher than the purchase price? If this conversation took place with the real estate agent, the request should have generated a contingency in the offer to purchase on the home. It is not uncommon for an offer to purchase to add a “satisfactory appraisal” contingency.

If they requested the home appraise for the purchase price and has an email or a verbal conversation witnessed by others, they might have a claim. If they do not have the so-called “smoking gun,” or they were silent on this subject, it may be too late.

Consider seeking an opinion from a competent real estate attorney. If they do not have an attorney, here is a link to an article about how to find a qualified attorney. Only a review of the legal documents and a conversation with an attorney can provide the guidance you seek to understand their legal position.