Reader Question: I am pursuing a business startup that compliments my family’s existing construction business. I have a little funding myself and some customers. I need to raise additional capital to grow and deliver the best service possible. My family business has shown interest in investing/loaning me some funds for developing this startup. I currently manage our family’s rental properties. I am curious if there are ways to obtain cash through owner financing of two company-owned properties. The company wants to sell them to fund a separate venture. I was trying to think outside of the box for ways to capitalize my venture through means of owner financed property. Is there any tactic for something like this?

Monty’s Answer: Some tactics may be applicable here. This type of financing works best when the parties involved have successful businesses, substantial reserves, and play in markets that will be around long into the future. We will assume your family’s business is in this category. There is a substantial risk with a startup. While we continuously hear about the success stories, the startup field has many smart, well-meaning people who had a good idea, yet failed.

Your family’s interest in helping you is the first lead to run down. Is the loan or investment they would make dependent on you buying the company properties? You and your family are both looking for capital to fund new ventures. The equity in the real estate the company intends to sell may have to be substantial to satisfy both of you.

Enough capital to go around?

Will your family sell you the properties at a below-market price? Can you negotiate a mortgage that does not prohibit you from taking a second mortgage? The second mortgage is a method to raise fresh capital. Your purchase price has to be below the market because you do not want to have negative cash flow, which defeats the purpose. You want to use the money in the startup, not siphoned off to support the real estate. If you utilize conventional financing, your family has the remaining equity from the sale to fund their new venture. This method is not risky for the company, but dangerous for you.

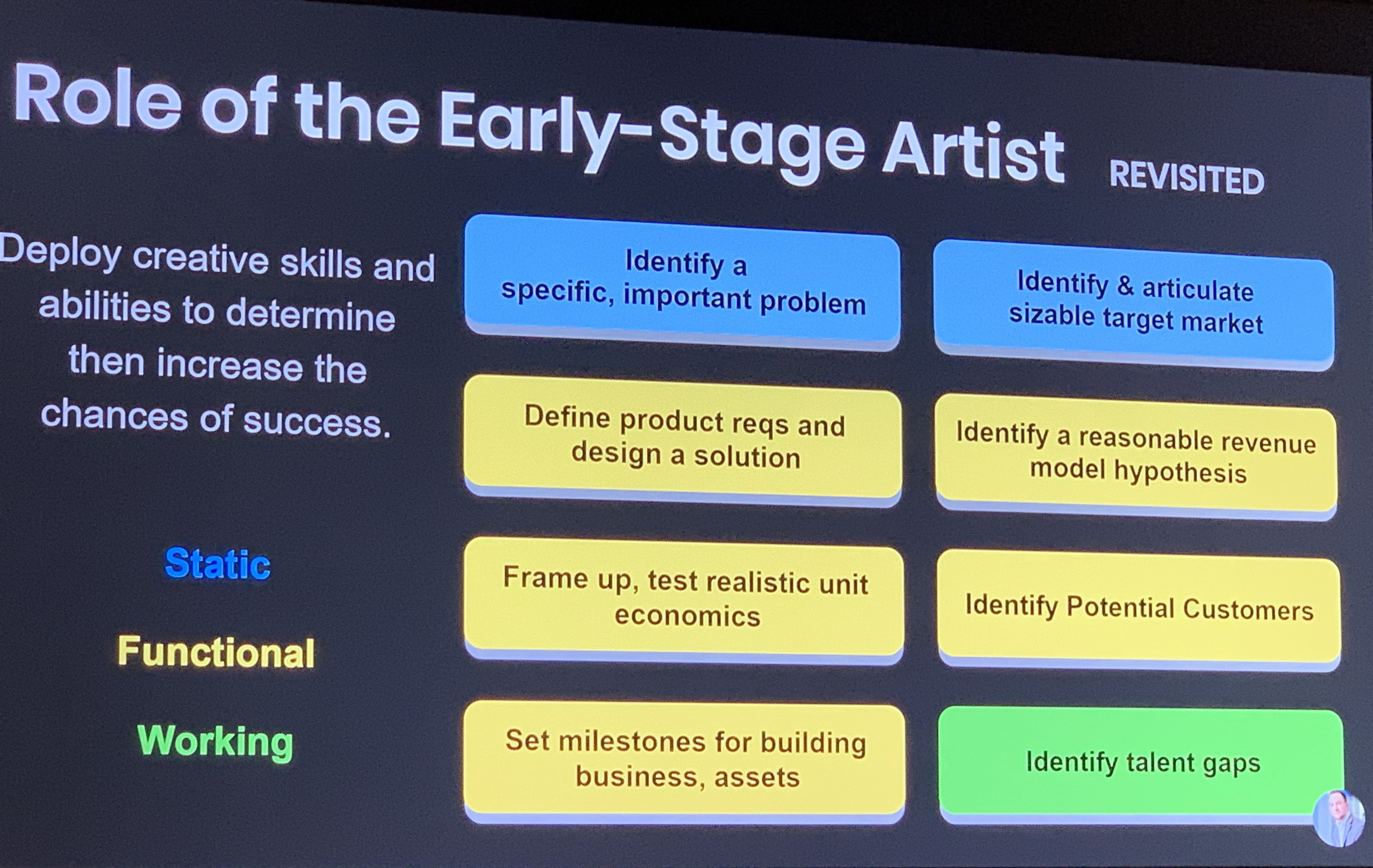

Consider looking at other alternatives. Do you need that much new capital? Overspending is one reason startups fail. Here is a link to advice on maximizing your chances called Startups in 13 sentences from Paul Graham, who proffers excellent advice for startups. Point number eight is about capital.

A new capital source

Seek investors or a loan that converts to an investment. Approach successful friends or business people you know. Before doing so, create a presentation sometimes referred to as a “pitch deck.” As an example, David Cancel runs a company named Drift; it offers a web-based live-chat service to help a business to communicate with their customers. Here is a link to the presentation points David Cancel used to raise money to help his company grow. There are many approaches to building a pitch deck to tell your story, and by published accounts, Cancel’s method is successful.

Richard Montgomery is the author of “House Money – An Insider’s Secrets to Saving Thousands When You Buy or Sell a Home.” He advocates industry reform and offers readers unbiased real estate advice. Follow him on Twitter at @dearmonty, or at DearMonty.com