Reader Question: Does zoning regulation affect affordable housing?

Reader Question: Does zoning regulation affect affordable housing?

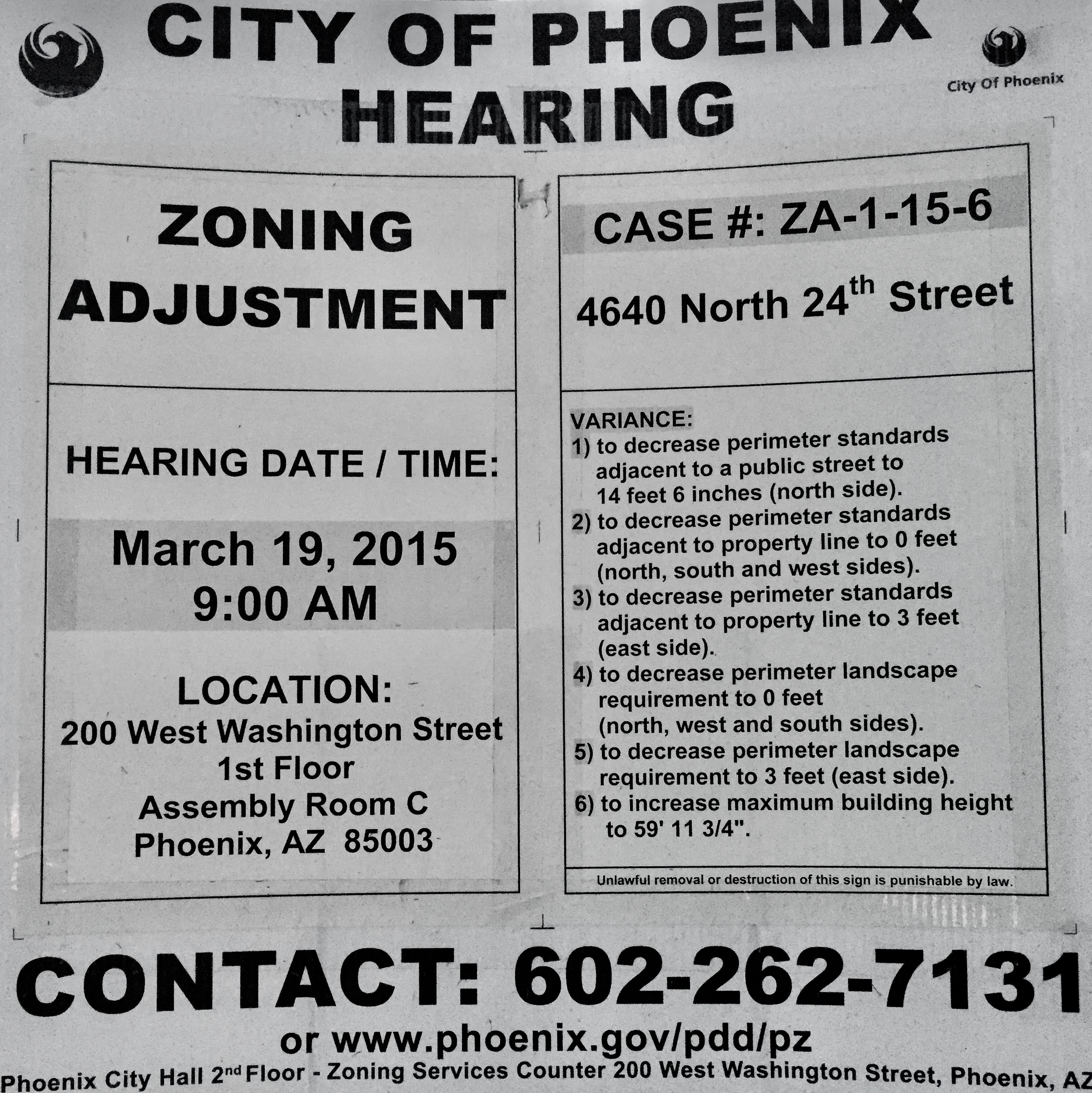

Monty’s Answer: Zoning and affordable housing prices go hand in hand. Zoning is poorly understood. When asking why housing is becoming more expensive, consumers and politicians alike often overlook zoning and regulations. Consumers don’t know how and don’t have the power to bring costs down. Politicians and bureaucrats could do so but often make things worse. Some believe that policy is often influenced by those that benefit from rising prices. See CATO Institute.

The importance of zoning

The more it costs to build a home, the more it’s going to cost you to buy it. Federal, state, and local rules, regulations, and building codes create restrictions making construction more expensive. Several years ago, a major home builder and land developer in Florida commented that it takes between 1.5 and 5 years for a subdivision to be approved. Approval must occur before he sells a new home lot. State, municipality, neighborhood demographics, and development zoning rules can increase approval time. Too many cooks! It’s especially bad in California. See California Department of Real Estate (DRE).

Why approval time affects home prices

Holding costs – Owning vacant land costs money! Consider interest, real estate taxes, insurance, maintenance cost, and opportunity-loss costs if the owner paid cash for the property. Interest rates are higher than a home mortgage. One million dollars at six percent for five years equals three-hundred thousand dollars. Holding costs add up quickly.

Market conditions – Projecting future sales is a dicey proposition. Local, regional, and national markets continuously change. When a downturn or a recession develops, it can turn success and bankruptcy. The longer it takes to secure all the approvals and start selling lots, the riskier the project becomes.

Risk increases required revenue – More regulations mean it’s easier for something to go wrong. Developers understand this risk going into a project, and higher risk needs higher returns. Increased prices to buyers increase those returns.

Why excessive regulation increase home prices

Most regulators have no accountability to the consumer – it is not their money at risk. This is 40 years of experience with municipal, state, and federal regulations talking!

Many regulations require additional human capital and expense. Environmental studies, soil condition reports, and traffic studies are examples of costly outside experts who needed to complete investigations. The extra staff required for correspondence, record keeping, and more adds cost. Developers incur these costs long before realizing any revenue and pass them on to the buyer.

Regulation can reduce land availability. The larger the minimum lot size, the fewer the number of parcels available. In my home state, a municipality I have dealt with requires a five-acre minimum lot size in one of their zoning classifications. I’ve heard of ten-acre minimum lots sizes!

What is the solution?

Legislation and regulations should be helpful, and often is necessary and beneficial. But obviously, things can get out of hand. An educated, aware electorate, local activism, and political pressure can help. There are politicians, such as Ben Carson, that are addressing the problem, but there’s no easy answer.