Reader Question: Is the seller of a home privy to the home’s appraisal value for which the buyer paid? Does the agent representing the buyer have that information? Who is entitled to the information or can access it? Is the agent or his/her company in a position to assist the seller in obtaining the information as the buyer refuses to share the appraisal? The closing is in a few weeks. It seems the appraisal must be significantly higher than the listing price. We are moving to another state and considering canceling the sale and renting the house. What are the financial ramifications if we decide to back out?

Monty’s Answer: A lack of critical information may impact my response, so these comments are qualified and general. While it is undoubtedly true that the appraisal may have exceeded the purchase price, several other possibilities are equally plausible.

Every state has real estate laws that vary. Many states, but not all, have pre-drafted fill-in-the-blank forms for uniformity. Unless the purchase contract requires the buyer to share the appraisal, it may not be mandatory. You need to consult a local attorney to review your agreement and render an opinion on the appraisal sharing requirement if there is one. Also, ask the attorney about the ramifications were you to break the contract.

Other possibilities

- Many buyers do not have an obligation or a willingness to share such information from a privacy point of view. Privacy could well be the reason the buyer has refused your request.

- Have you not received a copy of the lender’s approval document? With the closing still a few weeks away, the buyer may not yet have convinced the lender to make the loan.

- There may be an ongoing negotiation on the rate and terms.

- The appraisal may be too low. A negotiation may be in process on how to overcome the shortfall.

- Your agent may not know the amount of the appraisal.

Becoming a landlord

It has been my real estate experience property owners with little or no training or experience are at high financial risk becoming landlords. Some tenants know the law very well and take advantage of rookie investors. Incidents such as non-payment of rent, raising the ire of the neighbors, or damaging the property are common. Here is a link to an article about who should become a landlord that may be helpful. On the other hand, your background and training may blend well with the prospect of becoming a landlord.

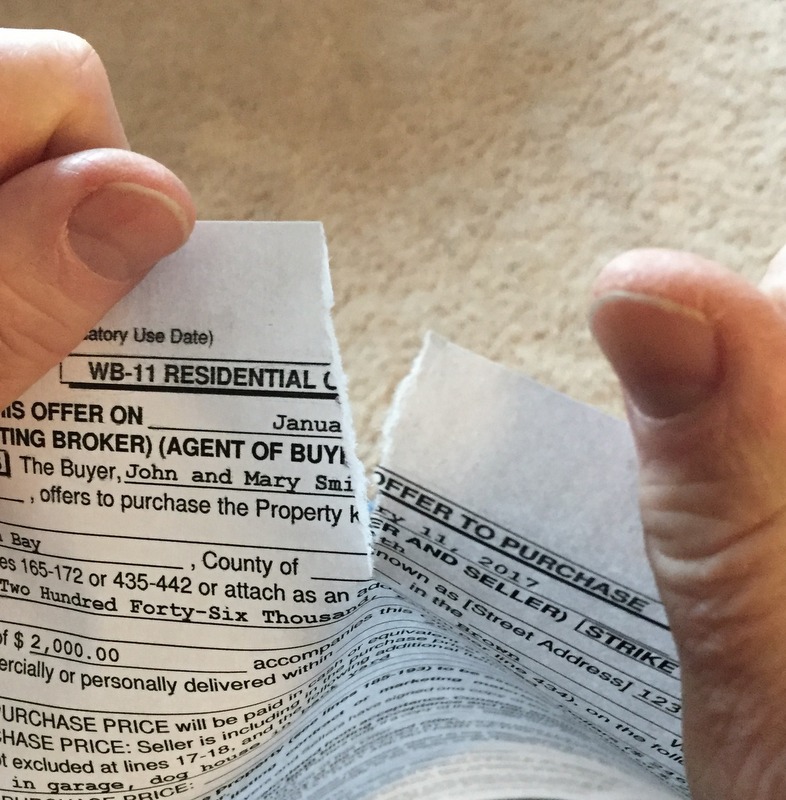

Always read contracts

Finally, it is unclear if you have read the contract. Real estate consumers sometimes abdicate contract details to a real estate agent. If you have not read the agreement, it may include the answers you are seeking. With the advent of internet websites and the lengthy “terms of service agreements,” plus the ever-growing number of pages in real estate documents, busy consumers have become accustomed to signing documents without reading them. I have no experience with website agreements, but not reading real estate contracts can lead to expensive predicaments. Please proceed with caution.