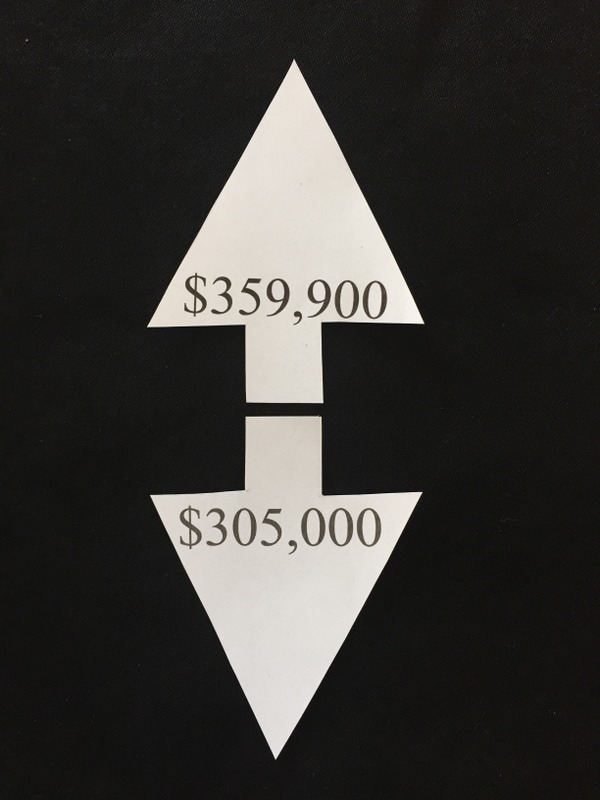

Reader Question: Our agent flip-flops on price. We listed our home two weeks ago for three hundred fifty-nine thousand nine hundred dollars. Our agent recommended this price and showed comparable sales that supported the recommendation. Yesterday they presented an offer for three hundred five thousand dollars and suggested we accept it. We are stunned and confused. This limited offer makes no sense to us. How could the value drop by fifteen percent, almost overnight? John and Sue L.

Reader Question: Our agent flip-flops on price. We listed our home two weeks ago for three hundred fifty-nine thousand nine hundred dollars. Our agent recommended this price and showed comparable sales that supported the recommendation. Yesterday they presented an offer for three hundred five thousand dollars and suggested we accept it. We are stunned and confused. This limited offer makes no sense to us. How could the value drop by fifteen percent, almost overnight? John and Sue L.

Monty’s Answer: There are some possibilities the situation you described has developed this way. There is no real historical information about the details of the presentation, how you found and interviewed the agent, and your circumstances. Before enumerating potential causes, a bit of real estate background is in order.

How real estate works

Unlike shares in a publicly traded company, where the share value is published daily based on thousands of transactions, the company shares (the product) are equal. When a stock price moves up or down, all the shares move. The value of a particular home (the product) varies because unlike identical shares, each home is unique. To have a range of value of twenty percent or more in your price range is common.

The law requires all real estate agents to put the client’s interests ahead of their own. They are also obliged to present all offers to a seller. The presentation must be objective. This means to review the advantages and disadvantages of every offer.

Additionally, every seller (or buyer) has a reason. No matter what the market conditions are like, usually buyers and sellers first consider their personal circumstances. Examples such as financial, emotional occurrences and time constraints often dictate when to buy or sell. Retirement or job change, severe injury, illness or death in the family, conflicts with neighbors and many other individual occurrences have an impact on the decision to buy or sell. It is not uncommon for these circumstances to change, sometimes quickly, and when that happens, the motivation to sell may also change either way.

Here are some possibilities as to what may be occurring:

Agent pushback – The agent may have lost confidence in the initial price. This change could have initiated through feedback from other agents in the office, prospect feedback or feedback from the agent that is working with the buyer. This scenario is most likely when the uniqueness of your home provides very few comparable sales and the range of value widens.

Fear of retribution – The agent may be reluctant to recommend a counter-offer because if they suggest a counter-offer, and you agree, but the buyer walks away from it, then the agent may be “blamed” for losing the buyer. If the agent suggests that you accept the offer, and you reject the suggestion and counter-offer, and the buyer walks away, it was entirely your decision.

Incompetency – Property evaluation may be one of the agent’s weak spots. Consumers incorrectly assume that a licensed real estate agent is proficient at evaluating the property. Here is the real scoop. The state regulators abdicate real estate appraisal training to the real estate companies. I have not investigated every state, so there could be exceptions, but I have found little if any appraisal standards taught in state pre-licensure or continuing education classes. It is up to the real estate company the agent signs on with to teach them how to evaluate a home, or for the agent to find appraisal classes on their own. There are many real estate agents that understand the evaluation process and practice it routinely; there are also many that do not.

Poor listing presentation – There was little time spent explaining the law, the weaknesses in the appraisal function, how the marketplace functions and in particular, how your market segment is performing. As an extreme example, if there are 35 homes comparable to your home currently for sale in your submarket, yet only two similar homes have sold in the past six months, the market suggests an eight-year supply. Your motivation for a sale may have caused the agent to make this suggestion.

A combination of these possibilities can occur. This information may be helpful to provide insights that lead to a quality conversation as to the best way to proceed with the offer to purchase. It will boil down to your confidence in the comparable sales and the interpretation of how your submarket is performing. Typically, a smart buyer viewing the same information may adjust their sights accordingly.