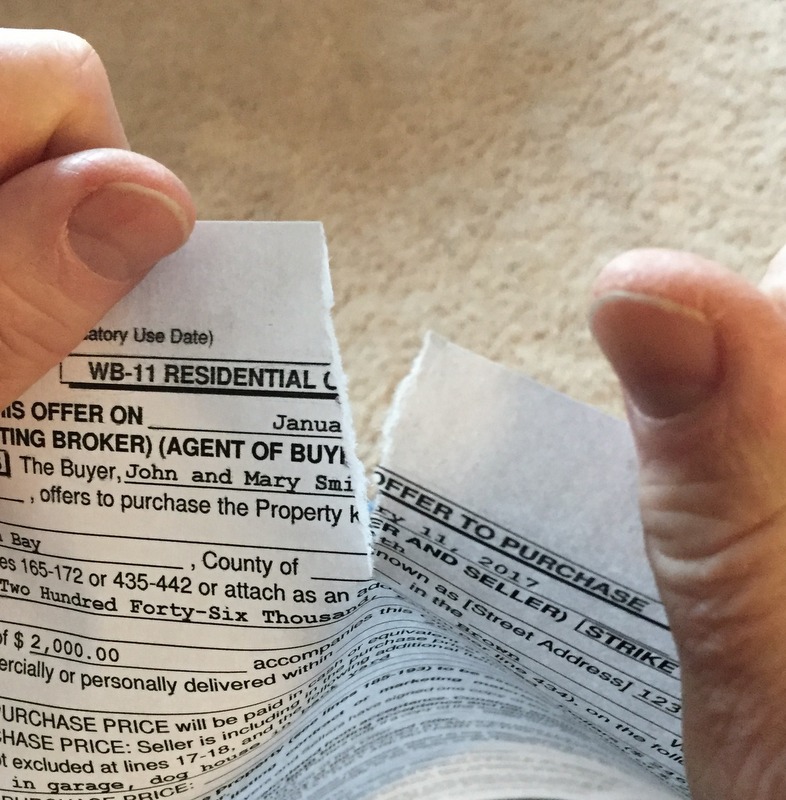

Reader Question: The seller canceled escrow when the house appraised low. I (the buyer) am stuck with the appraisal fees. Who is responsible for the fees I paid? What are my options?

Monty’s Answer: The answer is that you are responsible for the appraisal cost, whether or not the transaction closes. The terminology is likely in your loan application. Try to look past this bump in the road. Appraisals disrupting sales are frequent.

Your options are to walk away or try to keep the transaction together. Motivated sellers and buyers often find a way to re-energize the sale. If you have a knowledgeable real estate agent who understands financing and has already tried unsuccessfully, then this may not be an option. If neither of the agents tried to negotiate, then perhaps you could reach out to the seller. There is no specific information here, but there may be several ways to start a new conversation.

This article at http://bit.ly/2M8EEAs about valuing a home when buying or selling it may help. The gist of this article is that just because one appraiser stated a price does not make their price the last word.

A small rant

The federal government regulates what the lender can and cannot do in this situation. Every home has a “range of value” not an exact price. Politicians are well known for establishing inane law (prohibition sticks in my mind). In my experience HUD had a knee-jerk reaction after the 2008 real estate meltdown debacle that multiplied appraisal issues. Read more about that at http://bit.ly/3boBeDF.

Here are six possibilities

- Error in the appraisal – Appraisers rarely will change their minds. The exception is when someone, like you or the seller, discovers a significant error in their report.

- Different lender – It is unclear what type of lender you chose, but try a mortgage broker as there could be more options available.

- Can you improve your credit score? Sometimes the reporting agencies have it wrong. Correcting an error can sometimes mean lower payments.

- Seller finance – Home sellers have financed transactions. They know the collateral.

- Seller second mortgage – Provides a different way to structure the first mortgage loan. Brian Wickert of Accunet Mortgage says he is aware of only two second-mortgage restrictions. “If financing provided by the property seller is more than 2% below current standard rates for second mortgages, the subordinate financing must be considered a sales concession. One must then deduct the subordinate financing amount from the sales price.” The second restriction is, “There needs to be 5% remaining equity based on the appraised value when totaling up the first mortgage amount plus any second mortgage amount.”

- Portfolio or warehouse the mortgage – Some lenders keep mortgages in-house. When this is an option, many of the government rules do not apply, and added flexibility can help complete the transaction.

Consider bouncing these ideas off of the seller, the lender, and your real estate agent if you agree to the asking price. Nothing ventured – nothing gained.