Reader Question: I’m the homeowner. I listed my home with a real estate agent; however, I found an interested buyer on my own. If that buyer purchases my house with no help from the listing agent, “Who gets or keeps the commission? ”

Reader Question: I’m the homeowner. I listed my home with a real estate agent; however, I found an interested buyer on my own. If that buyer purchases my house with no help from the listing agent, “Who gets or keeps the commission? ”

Monty’s Answer: Your question is one that someone else in America is likely wondering about right now as well. With over five-million home sales expected this year, many home sellers will bump into potential buyers while selling their home. Not knowing the specific circumstances of your transaction, the difference between an interested buyer and an interested buyer that closes on a contract for your home may be insurmountable.

The agent’s job includes negotiating and managing the sales contract, which sometimes is very straightforward, but more often than not, a hurdle or several hurdles will threaten the closing. Sometimes, it is just trading phone calls with other vendors; but other times it is attending inspections, tracking contingency deadlines, and overcoming a buyer’s remorse, all of which take up chunks of time. If the buyer is inexperienced and needs a mortgage and is left to navigate through this process on their own, a much higher likelihood exists that the transaction will not close. If the buyer is an experienced cash buyer, the seller, unless they too have considerable real estate experience, is at a disadvantage.

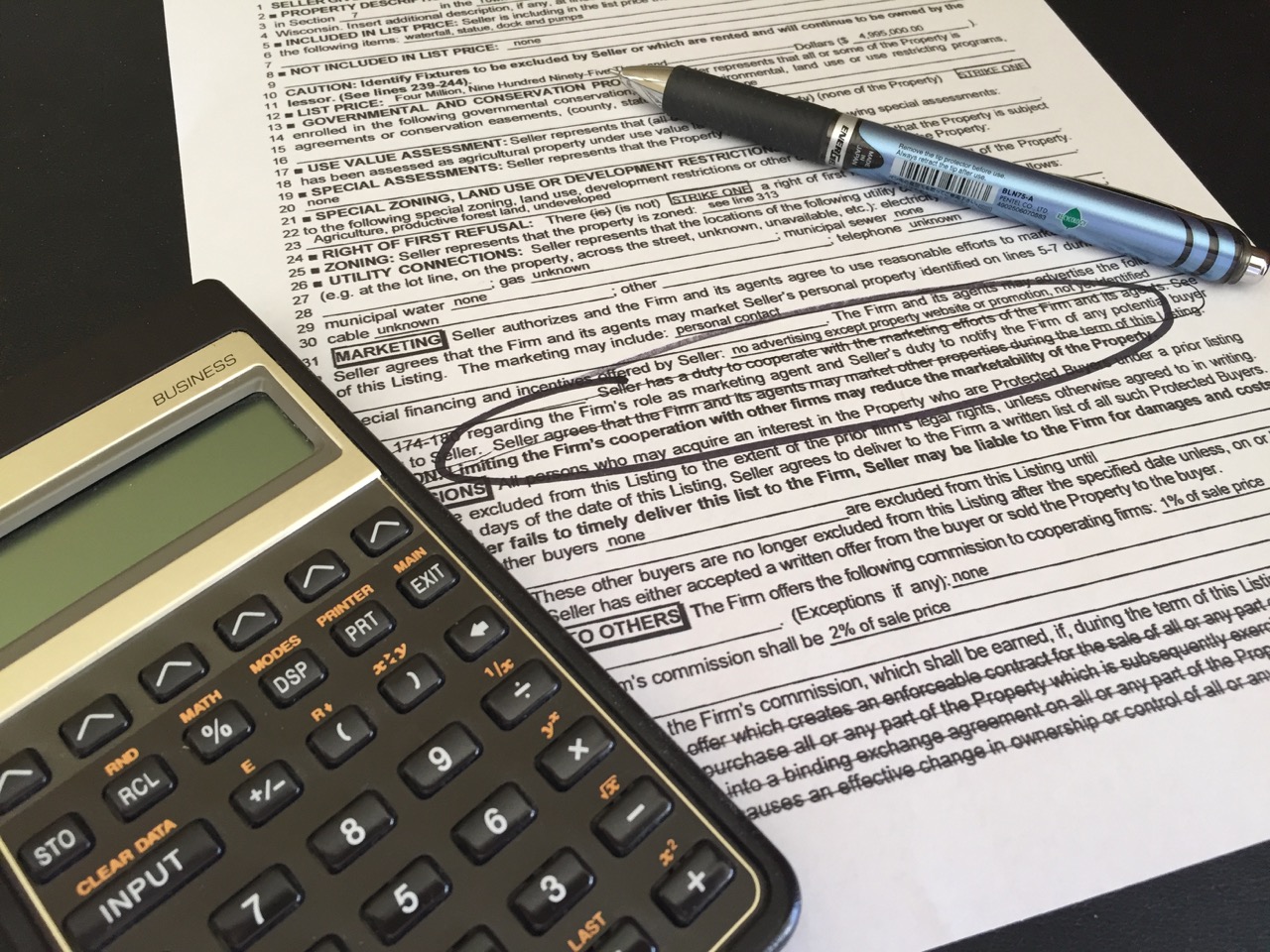

Your answer is in the contract

It is unclear which state you live in and the type of listing agreement that is in place. Each state has different laws and different types of listings. Assuming that your listing is an exclusive right to sell contract, which is the most common type of listing, it is likely that the agreement states the broker is paid the commission, regardless who procures the buyer. In the exclusive right to sell contract in many states, the seller agrees to turn any buyer leads over to the broker.

There are many “ifs” ahead

Finding the buyer is important, but it is just a portion of the real estate agent’s job. Once identified, a prospect in the typical transaction is then:

- is qualified to judge if their finances line up.

- If so, home is shown.

- If they like the property, they write an offer.

- If rejected, they write a counter-proposal.

- if accepted, some new conditions must be met. Commonly, a loan commitment, inspection, and appraisal are among other contingencies.

- If all of these events go without a hitch (or with glitches that are ultimately defeated), you are on your way to a closing.

- Many things can happen on the way to the settlement that can kill the contract. Loss of job, car accident, buyer purchases new car, disability, buyer remorse, failed inspection, etc.

- If the buyer navigates through the entire process, you had a closing and sold your home.

Remember the prep work

Assuming you chose an excellent real estate agent, considerable effort was invested even before the sign went up. From verifying city records to researching data to establish your home’s value and how best to approach the market. Then comes the staging, the photographs and last-minute walkthrough, the writing of ads, descriptor sheets for the multiple listing services, and more.

Negotiating the commission

Ask your agent if he or she will compensate you for turning up a buyer. Some agents will consider this; other agents will not. Some agents tell their sellers at the time of listing that they will reduce their fee if the seller can produce a buyer. The agent cannot decide to cut the fee, only the agent’s broker can authorize a change in the contract, which is between you and the broker, not the agent.

In requesting compensation, the circumstances can impact the response. Are you and the agent friends? Is the buyer a cash buyer, or are they pursuing a no-down-payment loan? In a seller’s market with an abundance of buyers, there may be a better buyer, with fewer potential obstacles, than the one you discovered.

Finally, many participants are sharing a real estate commissions. In the typical transaction, which is a co-broke sale, there are at least 4 participants, and if a referral fee is involved the number jumps to six participants. About thirty percent of all real estate transactions carry a referral fee. When the seller finds a direct buyer, the participants drop to two (three including the seller), which may improve the chances of a fee reduction.