Reader Question: My husband and I own a small business on a commercially zoned street in a city with about 100,000 people. We are thinking of selling the business and property. Could you recommend an appraiser here? The building is very old and is “grandfathered.” We also own an adjoining parking lot. We would like to plan ahead as much as possible. Thanks. Jean F.

Monty’s Answer: Hello Jean, and thanks for your question. Every seller has a unique situation. The circumstances described here call for a different approach. The ultimate sales price of your property will be different, either below or above an opinion provided in advance. The appraiser has superior methodology to follow when compared to a real estate agent, but a good real estate agent is not to be disregarded. Read this article titled “Valuing a home when buying or selling it” on DearMonty.com. It will provide a sense of what to expect with any appraisal. A business building is more difficult to evaluate because there are fewer comparable sales to compare against the subject property. Some commercially orientated appraisers and real estate agents limit their work to larger assignments.

Here is my advice about what to do in this situation. Read this article titled “Choosing your real estate agent” on DearMonty.com. Then, develop a list of 7-8 agents that sell commercial real estate. They may sell residential as well in a market of your size, but I would not consider an agent without commercial experience. Next, work the initial list down to 3 “finalists” through a process of elimination. Watch for signs on commercial property for sale along business areas around town. Look for patterns, like sold signs with the same name popping up. How extensive is their small business commercial experience? Do they handle similar commercial property? Some agents specialize. For example, they may only handle multi-family property. Do they sell a high percentage of their commercial property listings? Do they have a reference that sold a commercial property? Do they only handle their own property?

Invite the three “finalists” to tour the property and develop a price at which they think your property will sell. Let them know up-front you are interviewing other agents. Tell them one of the reasons for calling them is to learn the property’s worth. Ask them to provide a “range of value” on the property. What are the lowest price and the highest price to expect? Make certain they understand the expectation of “evidence” to back up their estimates. The evidence is data sheets of comparable property sales.

During the process of inspecting the property, or before, ask them the questions suggested in the article about choosing an agent that apply. Also ask a few questions about commercial property and their experience with it. Is property along your street selling? Is there a project proposed or committed to in the next year or two that could impact a sale now? If so, should we wait until project completion? It will be surprising at how differently the agents answer the questions. It is the process of listening carefully to their answers, taking notes and watching their body language that will help determine which agent may be the best fit for you if you decide to sell.

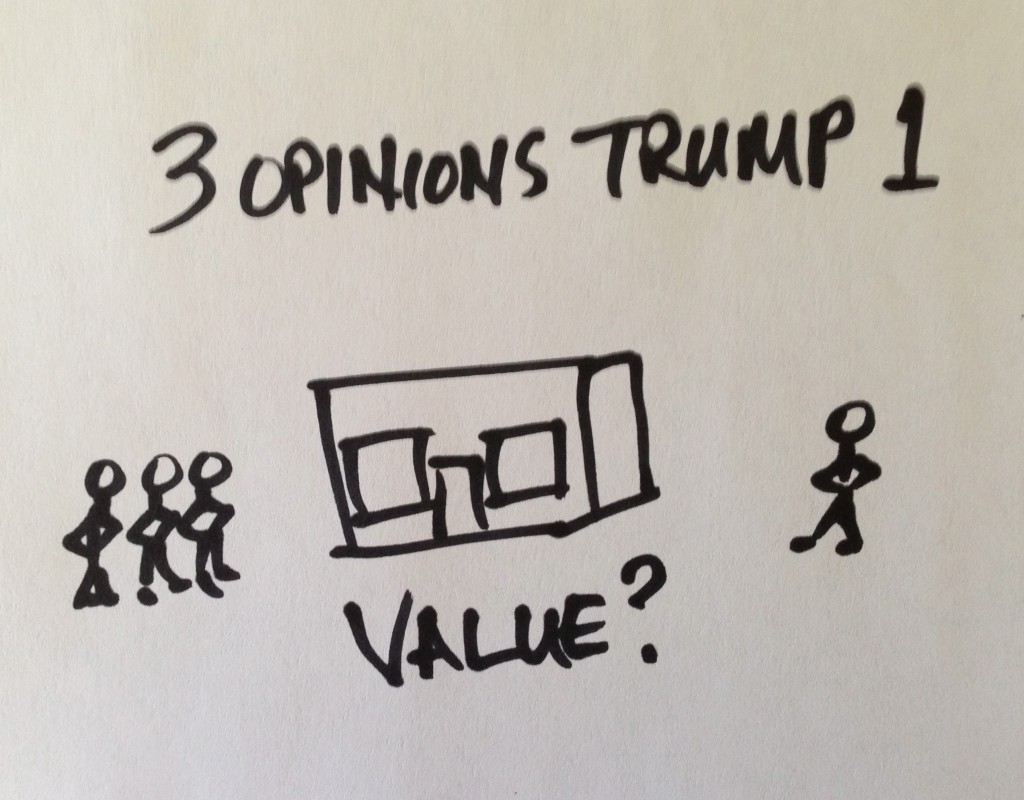

When utilizing this process, the 3 “finalists” doing this commercial work successfully may have better estimates than one appraiser. They will do this work without charging a fee, as this process is a normal part of finding new customers in real estate. If you feel uncomfortable with their conclusions, then hire an appraiser.

On the operating business that occupies the real estate, your accountant has formulas about determining what a business should sell for. A multiple of EBITA (earnings before interest, taxes and amortization) is a common formula. Different types of businesses have different multipliers.

An important question is could the business operate in another location? A driving range may be difficult to separate from the real estate, where it is relatively easy to relocate a retail store. Will the “grandfather” zoning disappear if the use changes or the business changes hands? Is the business worth more if it operates from the same building as always? These are all questions to ask each of the candidates.

I hope this information is helpful, Jean. Ask me other questions.

Leave a Reply

You must be logged in to post a comment.