Reader Question: Do homebuyers pay a commission when buying a home? We are planning on buying our first home in 2021. We do not pay a commission when we buy a home. Are we correct?

Monty’s Answer: Who pays the real estate agent is one of real estate’s most misunderstood questions. Depending on which “expert” is answering the question, there are three potential answers. They will postulate the seller pays, the buyer pays, or the two parties split the commission. You can check this statement out by searching online for “who pays the real estate commission.”

The answer

The reason that there are multiple answers is the correct answer is hidden. In this writer’s opinion, the seller pays the commission. The explanation follows.

Two important background principles

- The sale and purchase of a home is part of a cycle. The customer is the cycle. When a buyer purchases a house, that event represents the first half of the cycle. The second half of the cycle begins the moment the transaction closes.

- The marketplace does not recognize whether or not a home sale involved a commission. A home’s value is not affected by commissions. The marketplace is not a person. You will not find a line on any appraisal form that states the amount of the commission.

The proof

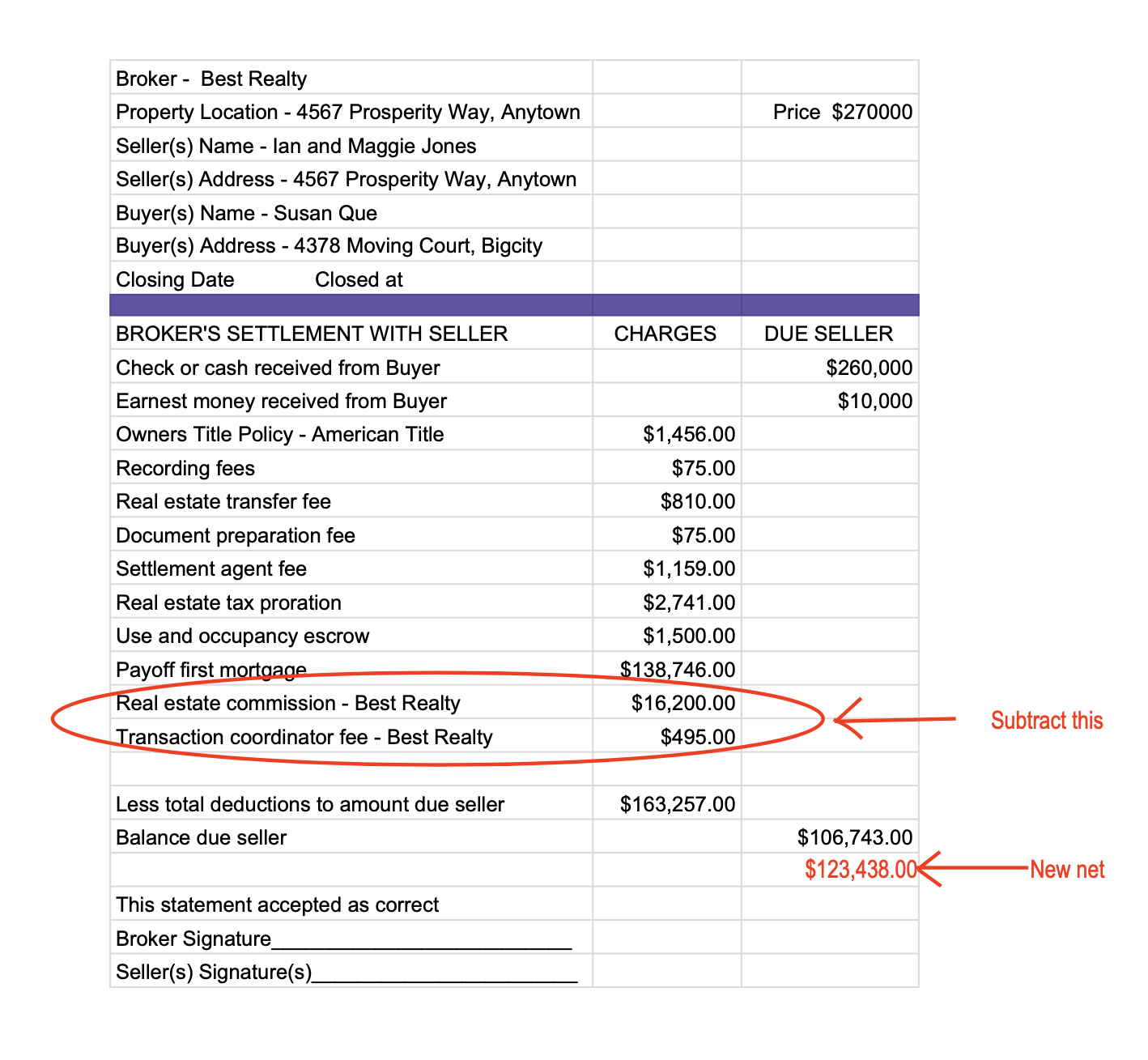

Homebuyers are not privy to the sellers closing statement. Here is a link to a redacted closing statement (https://bit.ly/2MoCi2d). The closing statement incorporates any fees or commissions the seller is obligated to pay in the purchase price. If there is a commission, it is paid only by the seller. The buyer’s closing statement does not list a cost for commissions. Because the listing broker paid the other broker outside the transaction, the seller pays the entire commission. So to the question, “Do homebuyers pay a commission when buying a home?”, the answer is no.

The hidden consequence

The buyer’s close and the first half of the sale cycle is now complete. The second half of the cycle is completed when the buyer resells the house. On the resale, they will now be responsible for the entire commission. Most buyers do not consider this when they buy a home. They are focused on acquiring it. Whether they sell the house in six months or 20 years, the commission will come out of any equity they built by paying down a mortgage or experiencing inflation. The financial danger appears when they complete the cycle in a year or two. Life events trigger sales that buyers cannot contemplate when they purchase. For example, death, divorce, or transfer are historically among the most common reasons for a home sale. If that event comes too soon after the purchase, the commission can wipe out their equity, or more.

The solution

The real estate industry has faced resistance on commissions for years from consumers, regulators, and consumer protection advocates. For example, The Consumer Federation of America commented at a forum two years ago sponsored by the Federal Trade Commission and the Department of Justice about real estate industry practices. You can learn more here in this Forbes article. Today, several new ideas have emerged around the country, creating new paradigms in real estate practice that utilize technology and new business efficiencies that reduce the cost of delivery to reduce commissions.